Oil prices rose slightly as US-led talks to end the war in Ukraine failed to achieve a breakthrough, and China pledged to support economic growth next year.

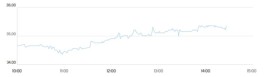

Brent crude futures for February delivery rose 2% to $61.88 a barrel at 9:42 a.m. London time, while similar contracts for West Texas Intermediate crude traded at $57.97, with gains of 2.2%.

While the United States has intensified its efforts to end the war in Ukraine, points of contention remain, highlighting the difficulty of ending the conflict.

US President Donald Trump said he made significant progress in talks held Sunday with his Ukrainian counterpart Volodymyr Zelensky at the Mar-a-Lago resort. The US president added that he aims to hold another meeting with Zelensky and European leaders in January. Meanwhile, Zelensky revealed that he asked Trump for security guarantees for a period of 30 to 50 years.

Oil is heading for its fifth monthly decline.

Oil is still on track for its fifth consecutive monthly decline in December, which would be its longest losing streak in more than two years.

Prices came under downward pressure due to concerns about a global supply glut, following increased production from the OPEC+ alliance, which includes Russia, as well as non-OPEC+ countries. However, geopolitical tensions, from Venezuela to Nigeria, have helped to halt the price decline in recent weeks.

Meanwhile, China pledged to expand its fiscal spending base in 2026, according to a statement from the Ministry of Finance on Sunday, signaling the government's continued support for driving growth.

China is the world’s largest importer of crude oil, and its economy has faced headwinds amid a prolonged slump in the real estate sector and increasing external pressures, including trade frictions with the United States.

Meanwhile, Beijing is expected to continue ramping up crude oil storage operations over the next year, helping to absorb the surplus.