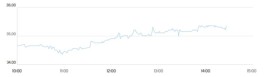

Gold prices edged lower on Monday after hitting record highs in the previous session, as some investors took profits and the US dollar edged higher, although geopolitical risks and expectations of a US interest rate cut continued to support the overall appeal of the precious metal.

Spot gold fell 0.4% to $4,513.55 an ounce by 08:51 Saudi time, after hitting a record high of $4,549.71 an ounce on Friday.

U.S. gold futures for February delivery fell 0.3% to $4,536.80 an ounce.

Gold prices rose by 4.5% last week.

Expectations of interest rate cuts and geopolitical risks are supporting gold.

The surge in gold prices has been largely fueled by the growing conviction that the US Federal Reserve will cut interest rates further next year.

Markets have increasingly priced in a faster easing cycle in 2026 as signs of easing inflation emerge, a backdrop that typically favors gold bullion by reducing the opportunity cost of holding it.

Expectations of a more accommodative monetary policy have also negatively impacted the dollar this year, further supporting gold prices.

The metal has performed exceptionally well in 2025, rising by more than 72% so far this year.

Analysts attribute this surge to a range of factors, including heavy buying by central banks, strong inflows into gold-backed exchange-traded funds, ongoing geopolitical instability, and demand from investors seeking a hedge against currency volatility and macroeconomic risks.

However, prices retreated on Monday from record highs after US-led talks aimed at ending the war in Ukraine failed to achieve a clear breakthrough.

Any lasting agreement that could reduce global tensions is seen as a potential obstacle for the precious metal, but recent developments have so far fallen short of that level.

Silver, platinum, and copper hit new record highs

Other precious metals also remained optimistic after strong gains.

Silver prices rose to a new record high of $83.62 an ounce, while platinum dipped slightly after hitting a record high of $2,478.5 an ounce earlier in the day.

Silver benefited from strong industrial demand along with its role as a safe haven, while platinum was boosted by supply constraints and improved demand prospects in the automotive and industrial sectors.

Benchmark copper contracts on the London Metal Exchange rose by about 7% to $12,937.90 a tonne after reaching $12,966.25 a tonne earlier in the day.

U.S. copper futures jumped more than 1% to $5.90 a pound.