The pound fell on Tuesday after UK labor market data showed a larger-than-expected rise in unemployment and a slowdown in wage growth, while stocks rose at the open, with wider European markets showing mixed performance.

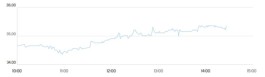

As of 11:11 AM Saudi time, the FTSE 100 index of major companies rose by 0.3% and the British pound GBP/USD fell by 0.5% against the dollar to 1.3573.

Germany’s DAX index fell by 0.06%, while France’s CAC 40 index rose by 0.2%.

Overview of the United Kingdom

The UK unemployment rate rose to 5.2% in the three months to December, up from 5.1% in the previous month, reaching its highest level since early 2021, according to data released Tuesday by the Office for National Statistics.

The rise in unemployment coincided with a marked slowdown in wage growth. Wage growth across the entire economy, excluding bonuses, fell to an annual rate of 4.2% in the three months to December, down from 4.5% in the previous period.

These indicators point to a further decline in the British labor market, which could increase pressure on the Bank of England to implement further interest rate cuts at its next meeting.

Meanwhile, Antofagasta PLC (LON:ANTO) announced record earnings before interest, taxes, depreciation, and amortization (EBITDA) for 2025, driven by higher copper and by-product prices. The company's revenue rose 30% to $8.62 billion, while EBITDA increased 52% to $5.20 billion, with the EBITDA margin widening to 60.3% from 51.8% a year earlier.

Pre-tax profits reached $3.16 billion, and earnings per share, including exceptional items, rose to 134.8 cents from 84.1 cents. Cash flow from operations increased by 30% to $4.25 billion. The board of directors proposed a final dividend of 48.0 cents per share, bringing the total dividend for the year to 64.6 cents per share, representing 50% of base earnings.

In other news, InterContinental Hotels Group PLC (LON:IHG) reported a 16% increase in adjusted earnings per share for 2025, reaching 501.3 cents compared to 432.4 cents a year earlier. The company opened a record 443 hotels during the year.

However, IHG's Americas business faced challenges, with revenue per available room (RevPAR) declining by 2% in the fourth quarter, the largest quarterly drop of the year, due to a decline in U.S. government travel and inbound international travel.

The company's board of directors approved a new $950 million share buyback program for 2026, following the completion of a $900 million buyback program in 2025. It also proposed a final dividend of 125.9 cents per share, a 10% increase, bringing the total annual dividend to 184.5 cents.

Coca-Cola European Partners PLC announced a 31% increase in operating profit for 2025 and unveiled plans for a €1 billion share buyback program on Tuesday.

The packager's reported operating profit reached €2.79 billion for the full year, while the comparative operating profit was €2.81 billion, representing a 5.4% increase on a comparative basis and a 7.5% growth on a comparative basis and in neutral currency.

Revenue for the year rose 2.3% to €20.90 billion, with adjusted revenue compared to neutral currency growing 2.8%, according to the company's unaudited preliminary results.