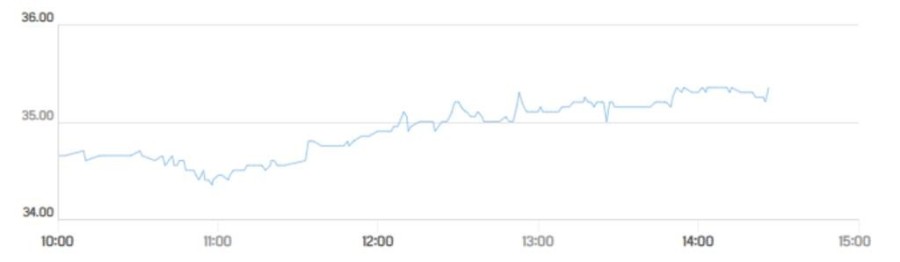

Emirates NBD shares made a strong showing in the Dubai Financial Market on Thursday, as they were the most attractive stock among all the companies present, and succeeded in exceeding the 35 dirham level, which reflects a great interest from traders in buying the stock at this time.

According to market data, the share price rose by 1.85% to AED 35.15, following buy and sell transactions totaling AED 101.611 million. During this period, approximately 2.9 million shares of the bank were traded across 1,954 transactions, making it the most actively traded stock in the market in terms of trading volume.

Emirates NBD Bank’s stock has been on an upward trajectory in recent days, starting from a price of AED 34.00 on February 5th. Despite experiencing a single decline on Monday of 1.32% to AED 33.60, it quickly and strongly rebounded.

By the end of yesterday’s trading, the price had settled at 34.65 dirhams, completing the picture of this positive activity in today’s session by reaching 35.30 dirhams, thus exceeding all its previous levels during this period.

The following table shows the stock's performance over the previous 5 sessions.

Emirates NBD, listed on the Dubai Financial Market, saw its profits rise by 4% in 2025, compared to 2024.

The bank’s profits reached AED 23.98 billion by the end of 2025, compared to profits of AED 22.97 billion by the end of 2024, according to the bank’s unaudited financial statements.

Operating income rose by 12% to AED 49.319 billion by the end of 2025, compared to AED 44.134 billion by the end of 2024.

The board of directors of Emirates NBD Bank, during its meeting yesterday, Monday, recommended distributing cash dividends to shareholders at a rate of 100% (equivalent to 100 fils per share) of the capital for the year 2025.

Emirates NBD's profits declined during the first nine months of 2025, on an annual basis.

The bank's profits reached AED 18.936 billion by the end of the first nine months of 2025, compared to profits of AED 18.990 billion during the same period of 2024, according to the bank's unaudited financial statements.

The bank’s general and administrative expenses rose by 16% to AED 11.17 billion during the first nine months of 2025, compared to AED 9.65 billion during the first nine months of 2024.