European stocks rose slightly on Monday, supported by a generally positive earnings season, although holidays in Asia and the United States resulted in limited activity.

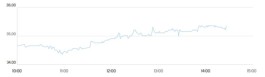

At 11:02 AM Saudi time, the DAX index in Germany rose by 0.4%, the CAC 40 index in France rose by 0.2%, and the FTSE 100 index in the United Kingdom also rose by 0.2%.

Strong corporate financial results boost sentiment

The week began quietly, with Monday marking the start of the Lunar New Year holiday in much of Asia and George Washington's birthday in the United States.

However, sentiment is generally positive in Europe, where corporate earnings growth has improved during the current reporting season amid a gradual improvement in the economic situation.

Companies representing 57% of Europe’s market capitalization have filed their reports so far, achieving an average profit growth of 3.9% in the fourth quarter, beating expectations that had predicted a contraction of 1.1%, according to data from LSEG.

So far, 60% of European companies have exceeded earnings expectations, compared to a typical quarter in which 54% of companies usually beat analysts' estimates.

Monday will be a relatively quiet day in terms of earnings announcements, but this week will see figures released by Europe’s four largest mining companies – Rio Tinto (LON:RIO), Glencore (LON:GLEN), Anglo American (LON:AAL) and Antofagasta (LON:ANTO) – at a time when the prices of the metals they extract have reached new record highs.

Volkswagen (ETR:VOWG) will also be in the spotlight after Manager Magazin reported earlier today that the German automotive giant plans to cut costs by 20% across all brands by the end of 2028.

In the United States, the highlight of the week's earnings will be Walmart Stores (NASDAQ:WMT), where the $1 trillion retail giant will announce its quarterly results on Thursday, providing a glimpse into consumer spending.

Eurozone industrial production data is anticipated.

In terms of economic data, the main release in Europe on Monday will be the Eurozone industrial production for December, which is expected to show a contraction of 1.5% on a monthly basis.

British house prices remained almost flat in February, with the average price of newly listed homes falling by just £12 to £368,019,000, after rising 2.8% in January, according to data from property website Rightmove.

Earlier in the session, Japanese growth data disappointed, with the country's GDP growing by just 0.2% year-on-year in the final quarter of December, well below expectations of 1.6%.

The data also showed a slight improvement in growth after a sharp contraction in the third quarter, which should bolster Prime Minister Sanae Takaichi's case for strong fiscal stimulus.

Oil prices stabilize ahead of crucial talks

Oil prices remained largely stable on Monday in holiday-affected trading, with attention fully focused on further dialogue between the United States and Iran.

Brent crude futures fell 0.1% to $67.66 a barrel, and U.S. West Texas Intermediate crude futures fell 0.1% to $62.68 a barrel.

Both contracts fell between 0.5% and 1% last week after comments by US President Donald Trump that Washington could strike a deal with Tehran within the next month led to a drop in prices.

The two countries are scheduled to hold a second round of talks in Geneva on Tuesday after negotiations resumed earlier this month aimed at addressing the decades-long dispute over Tehran's nuclear program.