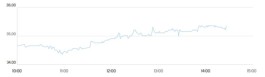

Gold fell below $5,000 an ounce as traders took profits from the previous session's gains, which were spurred by moderate US inflation data.

The price of the precious metal fell by as much as 1.5% on Monday, after rising 2.4% on Friday when the US consumer price index rose 0.2% in January, easing concerns about a larger jump and strengthening the case for the Federal Reserve to cut interest rates. Precious metals, which do not yield interest, typically benefit from lower borrowing costs.

In China, markets are closed this week for the Lunar New Year holiday, which means liquidity will be weaker than usual during Asian trading.

Demand for precious metals in the country has been frantic in recent months, prompting authorities in the retail hub of Shenzhen to issue a stern warning against illegal gold trading activities, ranging from apps offering loans to individual investors to live online broadcasts promoting bullion sales.

Weaker liquidity and technical stability

Hebei Chen, an analyst at Vantage Markets in Melbourne, said: With China and parts of the wider Asian market on holiday, gold is likely to see weaker liquidity and a quieter tone in early-week trading.

She added that recent price movements reflect orderly consolidation and light profit-taking after breaking above the $5,000 level following the US inflation figures on Friday.

Gold surged to a record high above $5,595 in late January as a wave of speculative buying pushed the rally to a breaking point, before a sudden collapse at the start of the month sent it tumbling to near $4,400. In volatile trading, the metal has since recovered about half of its losses.

Expectations of a new upward trend

Several banks expect gold to resume its upward trend, given that the factors contributing to the rise are still in place, including geopolitical tensions, questions about the independence of the Federal Reserve, and the broader shift away from traditional assets such as currencies and sovereign bonds.

ANZ Group Holdings Ltd. said it expects bullion to reach $5,800 an ounce in the second quarter, joining a group of financial institutions that have forecast higher prices.

Chen noted that structurally, the metal continues to show resilience; the macroeconomic background has been strong but not disruptive, and technical support remains in place.

Spot gold fell 1% to $4,989.64 an ounce at 2:10 p.m. Singapore time. Silver declined 1.8% to $76.03 an ounce. Platinum and palladium also saw slight declines. The Bloomberg Dollar Index, a measure of the U.S. currency, rose 0.1%.