Asian stocks rose in thin holiday trading, despite continued uncertainty over the prospects for artificial intelligence that still weighs on global stocks.

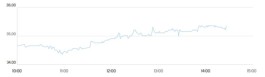

The MSCI Asia Pacific Index snapped a three-day losing streak to rise 0.6%, with Japanese stocks climbing more than 1.2%. Trading was thin as markets in China, Hong Kong, and several other regional exchanges were closed for the Lunar New Year holiday.

Meanwhile, the New Zealand dollar weakened, and the yield on the policy-sensitive two-year bond extended its decline after traders lowered their expectations for an interest rate hike by the Reserve Bank of New Zealand. Markets priced in a near three-in-four probability of a rate increase by October, down from 90% previously, after the central bank kept interest rates unchanged on Wednesday.

Artificial intelligence: between technological gains and returns concerns

Concerns surrounding artificial intelligence are also a source of anxiety in Asia, which accounts for a significant portion of global chip development and device manufacturing. The turmoil in global stock markets triggered by AI reflects a clash between fears that the technology will fundamentally transform large sectors of the economy and doubts about the ability of massive spending on it to deliver tangible returns in the near term.

The market remains close to its record highs, but some investors may not feel that way due to sharp sell-offs that derail the rally almost immediately, according to Chris Larkin of Morgan Stanley's E*Trade platform. He added: If this pattern continues, we could see a volatile market trajectory, even if the overall trend remains upward.

Investors also focused on the Federal Reserve's interest rate path following strong labor market data and moderate inflation readings. The Fed is scheduled to release the minutes of its January 27-28 meeting later on Wednesday, when it left interest rates unchanged.

Federal Reserve Governor Michael Barr said on Tuesday that interest rates should remain stable for some time until officials see more evidence that inflation is moving toward the central bank's 2% target. Chicago Federal Reserve President Austan Goolsbee indicated that further rate cuts could be made this year if inflation continues on its path toward the target.

Gold rises, oil falls

The yield on the 10-year US Treasury note held steady at 4.06%. Elsewhere, gold edged up slightly to trade near $4,900 an ounce, while cryptocurrencies declined, with Bitcoin trading around $67,300.

On the other hand, oil continued its losses from the previous session following positive talks between the United States and Iran regarding Tehran's nuclear program, which reduced the risk premium in crude prices. The Bloomberg Dollar Spot Index rose 0.1%.

In trade news, Japan plans to invest $36 billion in oil, gas, and critical minerals projects in the United States as the first installment of a $550 billion commitment under the agreement it reached with US President Donald Trump. The yen weakened slightly.

What do Bloomberg strategists say?

This week's 20-year bond auction is unlikely to trigger a repeat of the turmoil that followed January's auction. That event coincided with a historic sell-off, sending Japanese government bond yields soaring to multi-year highs across the curve. Since then, the bonds have recovered as traders have reacted positively to policy statements from Prime Minister Sanae Takaichi and her government.

Mark Cranfield, strategist at MarketLife.

However, the technology sector and the impact of artificial intelligence remained the dominant theme in global markets. The stock market turmoil triggered by the AI industry reflects increasingly conflicting concerns.

The market categorizes the winners and losers of artificial intelligence.

One of these concerns is that artificial intelligence could radically reshape entire sectors of the economy, prompting investors to sell shares of any company perceived as being at even a slight risk of being displaced by the technology.

Other concerns include deep doubts about whether the hundreds of billions of dollars that tech giants like Amazon, MetaPlatforms, Microsoft, and Alphabet are pumping into artificial intelligence annually will yield significant returns anytime soon.

Jan Bovan of the BlackRock Investment Institute said: “A few months ago, the market was debating whether artificial intelligence was real. Today, it’s seen as a real threat to business models.” He added: “We believe that the relentless search for winners and losers is fueling the massive expansion of AI—and the wave of borrowing to finance it.”