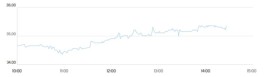

Gold and silver prices fell on Tuesday, extending losses from the previous session as metals markets remained nervous ahead of more key U.S. economic indicators expected this week.

Holidays in China and the United States led to lower trading volumes at the start of the week, while a slight rise in the dollar also affected metal prices.

Spot gold fell 0.3% to $4,978.39 an ounce, while April gold futures contracts declined 0.3% to $4,996.69 an ounce by 02:10 Saudi time.

Spot silver fell 0.9% to $76.0400 an ounce, while spot platinum rose 0.5% to $2,030.61 an ounce.

The strength of the dollar has affected metal prices, while demand for safe-haven assets has persisted ahead of nuclear talks between Iran and the United States, as Washington is seen as increasing military pressure to force Tehran into a deal.

Watch for US data and the Fed minutes this week

This week the focus is entirely on a series of economic readings coming from the United States, as well as the minutes from the Federal Reserve's January meeting, due to be released on Wednesday.

Industrial production data is due on Wednesday, while the personal consumption expenditures price index – the Fed's preferred inflation measure – will be released on Friday.

The latter will be closely monitored for further indications of the trajectory of inflation and interest rates.

Uncertainty over U.S. monetary policy has been a major factor putting pressure on gold in recent weeks, especially after President Donald Trump nominated Kevin Warsh to be the next chairman of the Federal Reserve.

Warsh is seen as a less lenient choice, as his nomination led to significant losses in the metals markets, where traders also collected profits after a speculative wave that pushed gold and precious metal prices to new record highs in January.

Recent inflation and employment data provided mixed signals about the world's largest economy, with inflation slowing slightly in January, while employment rose.