The dollar was broadly steady against most currencies on Monday, as traders awaited further clues on the path of U.S. interest rates, following cautious comments from Federal Reserve officials and despite signs of slowing inflation.

The Japanese yen held steady at 155.74 to the dollar, with traders awaiting any signs of government intervention.

The Japanese currency has moved in narrow ranges during the past two trading sessions, after a turbulent start to May following suspected interventions by Tokyo to support the yen, according to Reuters.

Data last week showed U.S. consumer prices rose less than expected in April, leading markets to price in a 50-bps rate cut, or at least two rate cuts this year. But comments from several Fed officials have been cautious about the timing of the cut.

This prompted traders to reduce expectations of a rate cut to about 46 basis points, while others expected the Fed to cut interest rates only once in November.

Markets are awaiting the minutes of the Federal Reserve meeting, scheduled to be released on Wednesday.

Purchasing managers' indices for the eurozone, Germany, the United Kingdom and the United States are also due out this week, along with a number of statements from central bank governors.

The euro rose 0.13% to $1.08825, approaching a nearly two-month high of $1.0895 touched last week.

The single European currency has risen 2% so far in May, on track for its strongest monthly performance since November.

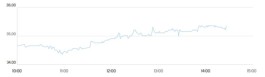

The dollar index, which measures the greenback's performance against a basket of six major currencies, was little changed at 104.44.

The index, which fell 1.7% this month, is on track for its weakest monthly performance in 2024.

Elsewhere, the pound hit a two-month high of $1.2711 ahead of a key UK inflation report due on Wednesday.

Markets are expecting 56 basis point cuts from the Bank of England, with the first cut coming in June.

The Australian dollar rose 0.18% to $0.67055, hovering near a four-month high, while the New Zealand dollar last traded at $0.61295, near a two-month high.