The US dollar rose slightly on Wednesday ahead of the release of the minutes from the Federal Reserve's latest meeting, while sterling climbed despite signs of easing inflation in the UK.

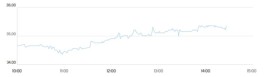

At 12:30 Saudi time, the dollar index, which tracks the performance of the US currency against a basket of six other currencies, rose 0.1% to 97.180, after a two-day rally.

The dollar rose slightly ahead of the release of the Fed minutes.

The dollar was pushed slightly higher this week, supported by more optimistic US economic data, including last week's jobs report, as well as uncertain geopolitical prospects.

This trend is expected to continue today, supported by data on durable goods orders and constructive industrial production, analysts at ING said in a note.

In addition, Iran and the United States reached an understanding on key guiding principles in a second round of indirect talks on their nuclear dispute on Tuesday.

Elsewhere, negotiators from Ukraine and Russia concluded the first day of two days of US-mediated peace talks in Geneva.

The minutes from the Federal Reserve's January meeting are due to be released later in the session, following the Fed's decision to keep interest rates unchanged and warn that risks to inflation and the labor market remain.

There needs to be a strong consensus on pausing, ING said, and this could limit current expectations of monetary easing from the Federal Reserve by about 59 basis points this year.

The uncertainty here stems from Kevin Warsh's potential arrival as Federal Reserve Chair in May and how he will lead the central bank. The market is closely watching for any confirmation hearing dates, which will be viewed as a downside risk event for the dollar.

Sterling rises despite falling consumer price index

In Europe, the GBP/USD pair rose 0.1% to 1.3570, with sterling climbing even after British inflation fell to its lowest level since March of last year.

Consumer prices rose 3.0% year-on-year in January, slowing from a 3.4% increase in December, as prices for transportation, food and non-alcoholic beverages rose less rapidly.

It's a rather mixed picture of inflation in the UK this morning. Food inflation has fallen sharply. This should be good news for hardliners, who were worried that high food inflation would trigger a more sustained and widespread wave of inflation. But services inflation is more stable – and, importantly, the Bank of England's core services inflation gauge has risen slightly, ING said.

The EUR/USD pair fell 0.1% to 1.1836, following a Financial Times report that European Central Bank President Christine Lagarde plans to leave her post early, ahead of next year's French presidential election.

Lagarde's term is scheduled to end in October 2027.

We expect the focus to shift to two leading candidates to succeed Lagarde: Spain's Pablo Hernandez de Cos and Germany's Joachim Nagel, who recently welcomed additional joint borrowing within the European Union. It seems premature for this story to impact the euro at this point, ING added.

The yen falls after trade data release.

In Asia, the USD/JPY pair rose 0.2% to 153.66, after data showed Japan's exports jumped 16.8% year-on-year in January while imports fell, leaving a smaller-than-expected deficit of 1.15 trillion yen.

The United States and Japan have announced the first details of Japan’s commitment to invest $550 billion in the United States, with the first deal being a $33 billion investment in a natural gas production facility in Ohio to be operated by a Softbank subsidiary.

Japanese direct investment in the United States will be a key watch factor this year, a factor that adds to the very mixed picture regarding the USD/JPY pair, ING said.

Elsewhere, the USD/CNY pair traded virtually unchanged at 6.9087, remaining close to its lowest levels in nearly three years as Chinese markets closed for the rest of the week.

The AUD/USD pair fell 0.2% to 0.7071, while the NZD/USD pair dropped 0.7% to 0.6003 after the Reserve Bank of New Zealand kept its official interest rate at 2.25% and indicated that policy would remain supportive as inflation returned to the target level.

The bank expects price growth to slow to around the midpoint of 2% over the next year amid excess capacity and modest wage pressures.