US markets experienced a period of anticipation and caution this week, as key economic data releases reshaped investor expectations regarding the future course of monetary policy. Inflation data took center stage, showing a relative slowdown in the pace of price increases, which bolstered market hopes for a possible easing of monetary tightening in the coming months.

Markets are closely watching the moves of the US Federal Reserve, which faces a delicate balancing act between curbing inflation and maintaining economic growth momentum. With inflationary pressures easing relatively, investors have increased their bets on a potential interest rate cut later this year, but strong labor market data continues to pose a challenge to policymakers.

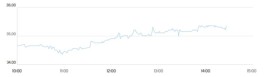

In the precious metals market, gold experienced significant volatility throughout the week. With the release of inflation data, prices initially moved upwards, driven by a weakening dollar and growing expectations of interest rate cuts, as gold is traditionally viewed as a safe haven and a hedge against inflation.

However, the gains were short-lived, as strong economic data, particularly regarding the labor market, limited the upward momentum of the precious metal. When the likelihood of interest rates remaining high increases, it enhances the appeal of yield-generating assets compared to gold, which does not offer a direct return.

This volatility reflects the sensitivity of the gold market to any change in expectations of US monetary policy, especially in light of continued global uncertainty, both geopolitical and economic.

In the energy market, oil prices were affected by mixed factors. On the one hand, expectations of improved global demand supported prices somewhat, especially with the continued recovery of some major economies. On the other hand, concerns about oversupply continued to weigh on the market.

The actions of OPEC and its partners play a pivotal role in determining price direction, as the organization strives to strike a delicate balance between supporting prices and maintaining its market share. Any changes in production policies or international sanctions can also have a direct impact on supply flows.

In addition, oil is closely linked to the trajectory of the US economy, as higher prices could reignite inflationary pressures, presenting policymakers with additional challenges in managing monetary policy.

Overall, market movements this week reflect continued caution and anticipation. Investors are weighing signs of slowing inflation against the strength of some economic indicators. The future direction of the markets remains contingent on upcoming macroeconomic data, particularly regarding inflation and the labor market.

While fluctuations in gold and oil continue, the decisive factor remains the direction of US monetary policy, which represents the main driver of global capital trends at the present stage.