The US stock market breathed its last week from the continued pressures of recession fears and high interest rates, after the end of the first full week of the earnings season, as it achieved strong gains by supporting the quarterly business results, along with speculations that the Federal Reserve may start reducing the pace of raising interest rates after the meeting. next November.

Wall Street indices achieved their best weekly performance since last June by about 5%, as Dow Jones recorded its third consecutive weekly gain, the longest weekly rising streak this year, with the recovery of all major sectors, led by banking shares.

The question here is, can corporate profits announced for the third quarter of this year provide support for stocks mired in recession fears? And does the policy of the US Federal Reserve, which is the most influential in stock movements currently, help this? This is what we will seek to answer in our next report, please kindly follow up

Earning season effect

Amid the difficult economic and political environment, eyes are turning to the current earnings season to assess the extent to which it can become a positive catalyst for stock performance, as was the case after the announcement of business results in the second quarter of 2022, which is credited with the recovery of Wall Street between mid-July and mid-August last (The most intense period in corporate earnings announcements for the second quarter), from its lowest since 2020 recorded in June.

For further clarification, we see that the US Dow Jones index rose from the level of 30,600 thousand points recorded on last July 14 until it crossed the 34 thousand points barrier on August 16, which was then the highest level since early May, as the following chart shows, the same of course As for the Standard & Poor's index, which rose during the comparison period from less than 3800 points to 4300 points.

* Performance of the Dow Jones Index since the beginning of 2022

Nevertheless, the stocks were later subjected to an intense sell-off with the Fed's more aggressive moves, with US stocks tumbling to their lowest levels since November 2020, and the Dow Jones fell less than 29,000 points by the end of September, and the volatility continued after that until the earnings season came to be encouraging for the return of Dow Jones Above 32 thousand points at the end of last week's sessions.

The Dow Jones index achieved a weekly gain of 4.7%, and the Standard & Poor's and Nasdaq indices rose by 4.9% and 5.2%, respectively, with major banks reporting profits that exceeded expectations thanks to high interest rates, despite their decline on an annual basis, such as Goldman Sachs Bank. and JP Morgan, who were among the top gainers in the Dow Jones Index last week with gains of 8.4% and 10% respectively.

This is in addition to major companies that showed business results that exceeded expectations, such as Netflix, whose share achieved a weekly gain of 26%, after it added 2.41 million subscribers in the third quarter, more than the expectations of the same company of only one million subscribers, and the company estimates the addition of an additional 4.5 million subscribers in fourth quarter of this year.

On the other hand, Snapchat's stock was one of the most prominent losers last week, as it fell by more than 22%, due to the company's announcement of recording quarterly revenues below expectations, but in general, after 20% of the companies listed on Standard & Poor's announced the results of the third quarter. As of Friday, 72% of that share reported higher-than-expected earnings per share, according to FactSet data.

It is worth noting that investors are more focused this quarter on the ability to exceed profits and revenues of analysts' expectations, even if they decline on an annual basis, with the fact that the numbers for the third quarter of last year were significantly higher as the economy recovered from the repercussions of the epidemic, and moreover that the quarter The same year this year, it is witnessing significant risks from fears of stagnation and persistent inflation.

So far, the initial signs indicate that the third-quarter earnings season will exceed analysts' estimates, which is more evident this week, which will be largely crowded from the quarterly business results, especially for giant companies that have weight in the US stock market, led by Apple, Microsoft and Google.

In another view, the chief stock analyst at Morgan Stanley, Mike Wilson, believes that the results of companies' business that came better than expectations in the third quarter of this year hide the pain that may happen to the stock market next year, noting that the current rise may continue. A month or two before it ends.

What about the policy of the US Federal Reserve?

Away from the earnings season momentum, markets remain preoccupied with the Fed's moves, which have been a major factor in stock losses this year, after raising interest rates 5 times, from almost zero last March to 3.25% for now, with more hikes expected as long as... Inflation continues, but reports emerged last Friday that the Fed may at least partially abandon the fight against inflation in order to allay recession fears.

The reality so far, according to the vision of international analysts, is that raising interest rates by 75 basis points has become a given in the upcoming November meeting, knowing that we at the Namazoon Economic Research Center believe that there are reasons and variables that lead us to believe that the next curfew will be at a rate of less than 75 points. You can even get a surprise of 25 points

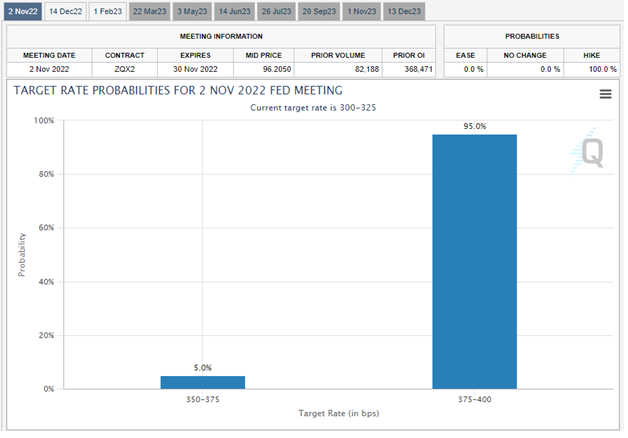

Markets are pricing in a 75 basis point (95%) hike with the remainder pointing to a 50 basis point hike, as Fiduch's benchmark interest rate tool makes clear, so the focus is more on how much the Fed is willing to slow the pace of rate hikes in subsequent meetings.

In this regard, a report from the Wall Street Journal said that some Fed officials are concerned about excessive monetary tightening, so it is possible to discuss this at the next meeting and if they will indicate that the interest rate increase is less than expected at the December meeting.

More bluntly, Fed Member Mary Daly said that the central bank needs to consider reducing the pace of rate hikes during upcoming meetings to 50 or 25 basis points, but at the same time, she emphasized that now is not the time for a complete stop.

These comments come at a time when investors are concerned that the Federal Reserve may over-tighten monetary policy in its attempt to tame inflation, driving the economy into recession. Is the Fed actually considering this even as inflation continues to accelerate, or are they just comments to reassure investors?

Iyad Aref

Founder of the Namazon website