The slowdown in sales afflicts the Amazon stock.. What about the next?

Amazon stock struggles between the hammer of slowing sales and the anvil of interest rates

The specter of economic stagnation is still chasing fast-growing technology stocks, especially Amazon, whose business depends mostly on sales and consumer demand, at a time when global central banks are fiercely fighting the high rate of inflation, which led to the Amazon stock recording strong losses that made the company on On the verge of losing the trillion dollar mark, will it recover from its losses or the worst is yet to come?

Amazon stock is currently standing at its lowest level in 3 and a half months, with online sales slowing this year, after two years of rapid growth, as the company benefited from the repercussions of the Corona pandemic and movement restrictions that encouraged online product ordering, which made the market value of the retail giant The electronic approach to the level of 2 trillion dollars, before it retreated significantly.

Strong decline in Amazon stock

Amazon stock ended last Friday’s trading, down by about 5%, to record $ 106.9 per share, which is the lowest level since the June 30 session, with reports indicating a decline in the value of sales during the Prime customers event last week, although the company announced in a statement that customers demanded more of 100 million pieces.

* Amazon stock performance in 12 months

Sales revenue that Amazon achieved during the marketing event period from October 12 to 13, amounted to about $ 8 billion, which is 25% less than Prime Day, which was held last July and generated revenue of $ 10.7 billion, according to estimates by Bank of America analyst Justin Post. This indicates a decline in consumer spending due to the high rate of inflation.

It is worth noting that the situation of retailers has been turned upside down, in In 2021, retail giants such as Amazon were worried about not having enough products in shopping seasons due to supply chain disruptions after Corona, and now, almost a year later, these companies are doing what they can to try to attract inflation-stricken shoppers, with concern about product backlogs.

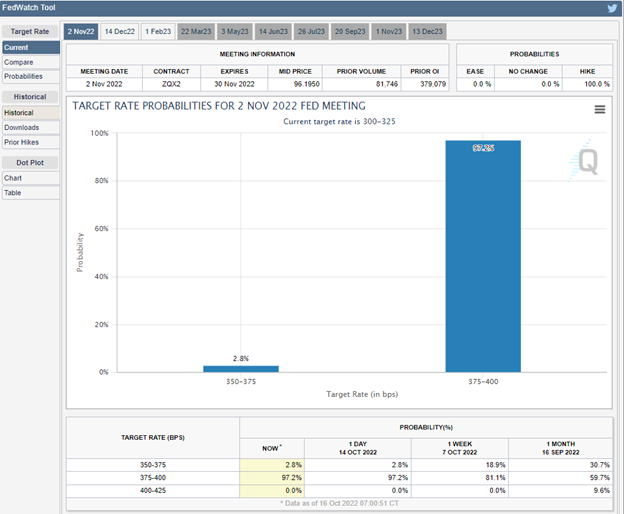

In addition to the direct impact of inflation on Amazon retail sales, there are other indirect repercussions, as the Federal Reserve was forced to raise interest rates strongly to curb inflation, until the US interest rate has so far reached the range of 3.25%, after it was near zero before last March.

The latest data indicated that the consumer price index in the United States increased by 8.2%, during last September, to be near its highest levels in 40 years, and this of course boosted the possibility of raising interest rates by 75 basis points during the Federal Reserve meeting in early November next for more than 97 years. %, according to the CME tool, which tracks US interest futures trading, as the following chart shows:

Higher interest rates and US bond yields negatively affect the value of future cash flows for growth stocks like Amazon, and higher interest also makes the financing that a company might need to develop its business more expensive.

With these negative factors, the Amazon stock’s losses since the beginning of this year amounted to about 36%, and more than 75% of its peak recorded in early July 2021 above $188 per share, with the market value at that time reaching $1.9 trillion, before declining since then and currently reaching to 1.08 trillion dollars.

What are the implications for financial performance?

There is no doubt that part of the decline in Amazon stock is due to losses in the broader stock market with investors fearing higher inflation and higher interest rates from the Federal Reserve, but the direct reason for the stock's decline this year is due to concern about the company's financial performance in particular and its ability to Achieving the same growth rates and profitability it achieved in the time of the Covid epidemic.

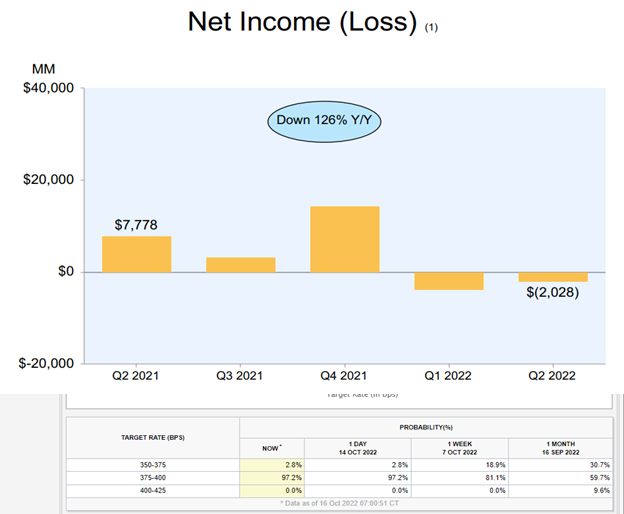

As Amazon announced in the first quarter of 2022, its first quarterly loss since 2015, amounting to $3.84 billion, compared to profits of about $8.11 billion during the same period in 2021, while the giant company’s revenues increased by 7% on an annual basis, To reach $116.44 billion during the first three months of this year, the slowest growth rate since the dotcom bubble burst in 2001.

Amazon's losses continued in the second quarter of 2022, reaching $2.028 billion, compared to a net profit of $7.77 billion in the same period in 2021, and revenue continued to grow at the pace of the first quarter of 7%, reaching $121.23 billion.

*Net Income for Amazon in one year

In an effort to cut costs and turn to profitability on a quarterly basis, Amazon decided to freeze appointments to administrative jobs for its retail business, in reference to the repercussions of slowing online sales, after it triggered a boom in hiring during the pandemic.

What about expectations?

Amazon expects revenue in the third quarter of between $125 billion and $130 billion, which represents a growth of 13% to 17% year-on-year, which may push the stock to recover, albeit relatively, from its recent losses, but if sales come as they look now less Expectedly, the stock will deepen its losses.

But investors will wait for the holiday season, which is supposed to be popular for e-commerce companies, led by Amazon, but the forecast is not so optimistic, as Adobe sees that consumer spending online during the holidays (from November 1 to December 31, 2022) is expected to grow by 2.5%, which is the smallest increase since data collection began in 2015, and down from the 8.6% growth last year.

Negative economic outlook could also affect demand, especially after the International Monetary Fund last week cut its GDP growth estimate to 2.7%, the weakest growth rate since 2001, warning that the worst is yet to come.

In the face of all this, Bank of America analysts still recommend buying Amazon stock with a target price of $157, which means an increase of about 45% from current levels, in an optimistic view that focuses on the long term.

As for the technical point of view of the movement of the arrow

With trading today, November 17, and the Amazon stock closing at $113.79, we believe that the stock formed a bearish peak in November 2021 from the $188 level, to begin a three-wave price correction journey, with price targets extending to $92 and $84, and we recommend actually investing in the stock And the cumulative buying is from the target range, and the bearish momentum will continue as long as the stock remains below the $134 level

It is true that the investor in Amazon stock in the near term may face some fluctuations in the stock price, because inflation is still high and exacerbates costs for the company, in addition to the fact that more interest rate hikes are still on the table, which may raise market concerns more.

But for the long-term investor, Amazon remains a leader in e-commerce and cloud computing, putting in a strong and attractive financial position that investors can view as a store of value in the coming years.

Iyad Aref

Founder of the Namazon website